Pengaruh Mekanisme Konflik Keagenan Terhadap Kinerja Perusahaan (Studi di Pasar Modal Indonesia Periode Tahun 2004-2010)

Abstract

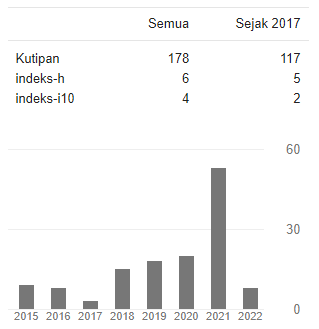

This research aims to test of agency theory in Indonesian Stock Exchange as proxy variables within agency conflict mechanism for firm performance. It is used secondary data from Indonesian Capital Market Directory (ICMD) and OSIRIS include all industry manufacture, exclude insurance and finace service sector. It's appropriate sampling criteria's and listing in Indonesian Stock Exchange. Then, using pooled data with observation period 2004th round to 2010th. Variables used in this study is the first Asset Utility as agency cost as dependent variabel. The second variabels is dividen, leverage, institutional ownership as mechanism variables to agency conflict as independent variable. Then, the control variable used firm size. The method of analysis used in this study is multiple regression of pooled data analysis. The results of this study is a positive effect dividend to company's performace of the first. Then, the second is a positive impact leverage to company's performace. The last is a positive impact institutional ownership to company's performace. With the result that, mechanism varibles of agency conflict has been play function of binding and oversight of agency conflict.

_mini-1.jpg)

1.jpg)